Customer is King

Even when speaking of venture capital, users are the ones who truly decide whether your startup will get an investment. VCs rigorously analyze everything about how customers deal with your business. Even in the early stages, user metrics can give quite an accurate view of your business perspectives. They define product/market fit, the stickiness of a product, future marketing efforts, potential income, and, as a result, the likelihood of investments to be returned and multiplied.After all, users are the ones with the money, and it’s totally up to them to decide whether they give it to you or to someone else.So, even with a state-of-art financial report, you may lose the funding round if your user metrics are poor. Let’s explore the most crucial ones:

DAU, WAU, MAU

These indicators reveal how many individuals interact with your product within a certain timespan. Both VCs and founders find this metric crucial, as it defines the maturity, stickiness, and growth potential of a business.

Depending on the industry and vertical your app belongs to, active users may be reported as:

These indicators reveal how many individuals interact with your product within a certain timespan. Both VCs and founders find this metric crucial, as it defines the maturity, stickiness, and growth potential of a business.

Depending on the industry and vertical your app belongs to, active users may be reported as:

- DAU (Daily Active Users) – common for projects that require daily usage, such as email, social networks, gaming, certain kinds of health and educational apps, and more.

- WAU (Weekly Active Users) – more typical for forums, productivity or analytical software, and other apps that are utilized on a weekly basis.

- MAU (Monthly Active Users) – normally for various B2B tools that are used a few times a month or even less (security, accounting, etc.).

How to calculate DAU

Though counting DAU may seem as easy as a pie, you won’t find two organizations that do it the same way. The main sticking points here are who constitutes a user and what counts as an action. While most the companies agree on essentially the same definition of a user, a useful action may vary significantly from business to business. Here are only a few common examples of what actions are considered to be valuable in different verticals:- Online media: Visit, page impression, share with friends

- Mobile game: Sign up, play, invite friends

- SaaS solution: Task creation or completion, add a teammate

Derivative metrics

There are a few advanced ways to analyze your audience based on DAU that will give you deeper insight into how your subscribers typically behave.- New/Returning users ratio: Within your active users, there are new and old ones. Measuring them separately will allow you to assess how good your app is at attracting new customers and retaining old ones.

- DAU / MAU ratio: If it is greater than 1, your user base is currently growing. If it’s null, then the growth has stopped.

Risks and limitations

Taking an action is not always taking the right action. For example, if you’re an owner of a mobile app, you may be delighted by a massive boost in DAU. However, if it is accompanied by a decrease in purchases, then it’s more like a canary in a coalmine, signaling that profitable users are being replaced by unprofitable ones. In this case, you may want to rethink your acquisition or even monetization politics. To get the most out of DAU, you should match it with other metrics, such as purchases, downloads, page views, shares, and more.ARPU

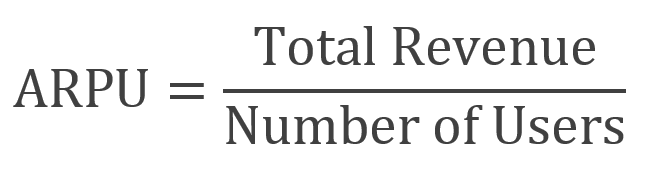

How to Calculate ARPU

Simply take your revenue from within a defined timeframe and divide it by the number of users who have visited your product within this period. Most companies calculate ARPU on a monthly basis. However, it might make sense for some business to rethink their measurements. For example, booking services such as Airbnb may prefer to use a quarter as a default period, as they don’t expect people to travel every month.

Most companies calculate ARPU on a monthly basis. However, it might make sense for some business to rethink their measurements. For example, booking services such as Airbnb may prefer to use a quarter as a default period, as they don’t expect people to travel every month.

ARPU and ARPPU

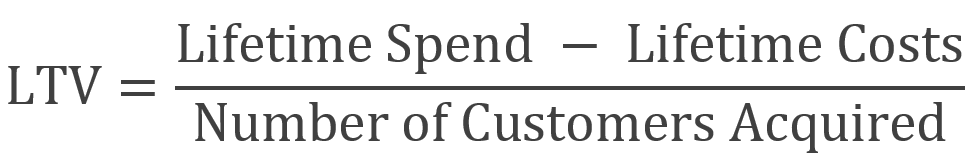

While ARPU is utilized to assess the average revenue per all of your users, ARPPU (Average Revenue Per Paying User) only accounts for paying users. It shows how much a loyal client is ready to pay for your solution. You can also interpret it as an audience’s reaction to your rates. For example, when you raise your prices, your ARPPU will increase respectively. However, that doesn’t mean that you’ll be earning more, as the number of paying customers can fall as well.ARPU and LTV

Some confuse ARPU with LTV (lifetime value). These are related, but still quite different, metrics. Generally, the lifetime value measures the average revenue a user brings you within an entire subscription period. It also includes costs like support, fees, refunds, etc. In other words, lifetime value indicates the profitability of your clients on a unit basis, while ARPU shows your revenue flow on an ongoing basis.

In other words, lifetime value indicates the profitability of your clients on a unit basis, while ARPU shows your revenue flow on an ongoing basis.

How to get the most out of it

1) Use it for segmentation Many businesses segment their users by subscription plan. For example, SaaS companies often divide clients into separate tiers, such as freemium, entry and enterprise. When exploring ARPU for these groups, you can come up with valuable insights.

For example, your enterprise-level subs will generate higher ARPU than those subscribed to the entry-level plan, while support costs for both of these segments will be the same. Considering this information, you may consider changing your pricing or plan features to balance the revenue for each of your customer groups.

2) Revenue forecasting

Many businesses segment their users by subscription plan. For example, SaaS companies often divide clients into separate tiers, such as freemium, entry and enterprise. When exploring ARPU for these groups, you can come up with valuable insights.

For example, your enterprise-level subs will generate higher ARPU than those subscribed to the entry-level plan, while support costs for both of these segments will be the same. Considering this information, you may consider changing your pricing or plan features to balance the revenue for each of your customer groups.

2) Revenue forecasting

Many financial models may demand revenue forecasting. It’s especially common when planning budgets or assessing the results of various user acquisition activities. By multiplying the number of acquired customers by your ARPU, you can calculate your approximate future revenue. You can also make regular corrections to your plan if you assume your ARPU will change with time.

Many financial models may demand revenue forecasting. It’s especially common when planning budgets or assessing the results of various user acquisition activities. By multiplying the number of acquired customers by your ARPU, you can calculate your approximate future revenue. You can also make regular corrections to your plan if you assume your ARPU will change with time.

K-Factor

This metric was inspired by the medical field of epidemiology, which is the study of how viruses spread over the population. However, instead of measuring the contagiousness of a disease, it indicates the virality of ideas, content, or businesses.

This metric is not that crucial for companies that rely on direct marketing, such as cold calls, emails, PPC, etc., but for projects that depend on word of mouth, such as social media apps, the k-factor is a key indicator of success.

This metric was inspired by the medical field of epidemiology, which is the study of how viruses spread over the population. However, instead of measuring the contagiousness of a disease, it indicates the virality of ideas, content, or businesses.

This metric is not that crucial for companies that rely on direct marketing, such as cold calls, emails, PPC, etc., but for projects that depend on word of mouth, such as social media apps, the k-factor is a key indicator of success.

Check out a related article: Benefits of Startup Valuation and the Factors Influencing It

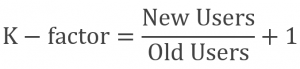

How to calculate k-factor

Track all invites sent by your users within a certain time span and count the number of all newcomers that joined your venture through this channel. Then, find the new/old users ratio and add 1. If the k-factor is greater than 1.2, then you’re witnessing quite rapid growth. (If your weekly k-factor is 1:2, your app’s population is doubling each month. Way to go!)

If the result is close to 1, then your user base is stable.

You may also face the situation when the quantity of users at the end of the researched period is less than in the beginning. If you don’t take action to fix it, you risk losing your audience.

If the k-factor is greater than 1.2, then you’re witnessing quite rapid growth. (If your weekly k-factor is 1:2, your app’s population is doubling each month. Way to go!)

If the result is close to 1, then your user base is stable.

You may also face the situation when the quantity of users at the end of the researched period is less than in the beginning. If you don’t take action to fix it, you risk losing your audience.

Risks and limitations

As good as they may feel, periods of skyrocketing growth can’t last long (though there are exceptions, like Facebook or Snapchat). Sooner or later, your users will run out of friends to invite, and the k-factor will stabilize. This may mean that you're either approaching the limits of your potential audience or that your idea has become less popular among users.Cohort Analysis

Cohort analysis can be a rather depressing metric since it shows the pace at which users abandon your product.

The bitter truth is that every business loses clients with time, and there are dozens of reasons for them to leave. For example, in a B2B environment, customers may get a better offer from your competitors, or they might be shutting down their operation. In B2C, it’s usually price issues or infoglut that causes your offer to get lost among similar offers.

It’s painful to watch your clients leave, but performing this analysis will help you better assess your acquisition activities. Investors love studying this metric as well, as it shows the stickiness of a product.

Cohort analysis can be a rather depressing metric since it shows the pace at which users abandon your product.

The bitter truth is that every business loses clients with time, and there are dozens of reasons for them to leave. For example, in a B2B environment, customers may get a better offer from your competitors, or they might be shutting down their operation. In B2C, it’s usually price issues or infoglut that causes your offer to get lost among similar offers.

It’s painful to watch your clients leave, but performing this analysis will help you better assess your acquisition activities. Investors love studying this metric as well, as it shows the stickiness of a product.

How to perform cohort analysis

Take all of the users who have acquired your product (visited your website, downloaded your app, etc.) within a certain time frame (normally a week). Then, calculate how many of them returned to it the next week and the week after. Depending on your industry, churn rates can vary significantly. Usually, they are much higher in B2C. For example, for social media startups, retaining only 20% after the first week is a poor number, 60% is OK, and 80% is kind of a miracle. Paid B2B products like SaaS do not lose clients quickly. Normally, their weekly churn rates don’t exceed 3%.Get the most out of it

Here are just a few additional tips to keep in mind when performing cohort analysis. 1) Google to the rescue Cohort analysis is one of the standard reports in Google Analytics. So, if you’re running a web application, you can not only assess user retention but also study the behavior patterns of each cohort. It’s especially useful for assessing the results of short-term acquisition campaigns.

2) Seasons matter

Cohort analysis is one of the standard reports in Google Analytics. So, if you’re running a web application, you can not only assess user retention but also study the behavior patterns of each cohort. It’s especially useful for assessing the results of short-term acquisition campaigns.

2) Seasons matter

For instance, an eLearning startup can get a decent boost in returning users at the beginning of a school year.

3) Forgetful we

For instance, an eLearning startup can get a decent boost in returning users at the beginning of a school year.

3) Forgetful we

Sometimes a loss of clients is not because they lack interest in your product. Overwhelmed by the tonnage of information available online, they can simply forget about you. Running a remarketing campaign can bring many of them back.

Sometimes a loss of clients is not because they lack interest in your product. Overwhelmed by the tonnage of information available online, they can simply forget about you. Running a remarketing campaign can bring many of them back.

Sum Up

As you may have already noticed, user metrics are highly dependent on the subjective perception of your business. Even the strongest idea can be buried by an obsolete design, an inconvenient interface, or too many bugs and errors. At the same time, mediocre (but still useful) concepts can gain quite a buzz simply due to a pleasant look and feel. This means that you cannot forget to pay special attention to your product’s UI/UX and quality assurance. Feel free to contact us if you need help or advice regarding this matter. And don’t hesitate to subscribe to our newsletter. This is not the last article in the series 😉←PREVIOUS Ultimate Guide to Evaluating Your Startup. Part 1: Finances NEXT: Ultimate Guide to Evaluating Your Startup. Part 3: Marketing

Leave a Comment