Hi there! It’s been a long time since we published the last article in the series. We hope it has been worth the wait and that you'll like today's new release. If you haven't read parts 1 and 2, here are the links:

Part 3 will be right here waiting for you when you return.

Why does marketing count?

A good product sells itself. Do you agree with this statement? If you ask us, the answer is “yes and no”.

It's true that a useful, in-demand and high-quality product drives impressive organic business growth. But, well, you still need to introduce it to public... to the right public in the right way. For your business to skyrocket, you first need to collect a critical number of loyal clients whose recommendations will drive your acquisition machine. Otherwise it may get no attention and instead of being an ultimate salvation, it can become your personal problem.

Another thing you need to consider is that marketing is always an investment. In other words, we spend money on promotion hoping to get it back many fold in the form of sales growth. In this article we'll review the most essential metrics to indicate your marketing efficiency:

We hope our advice will help you finetune your marketing machine to run like Swiss clockwork.

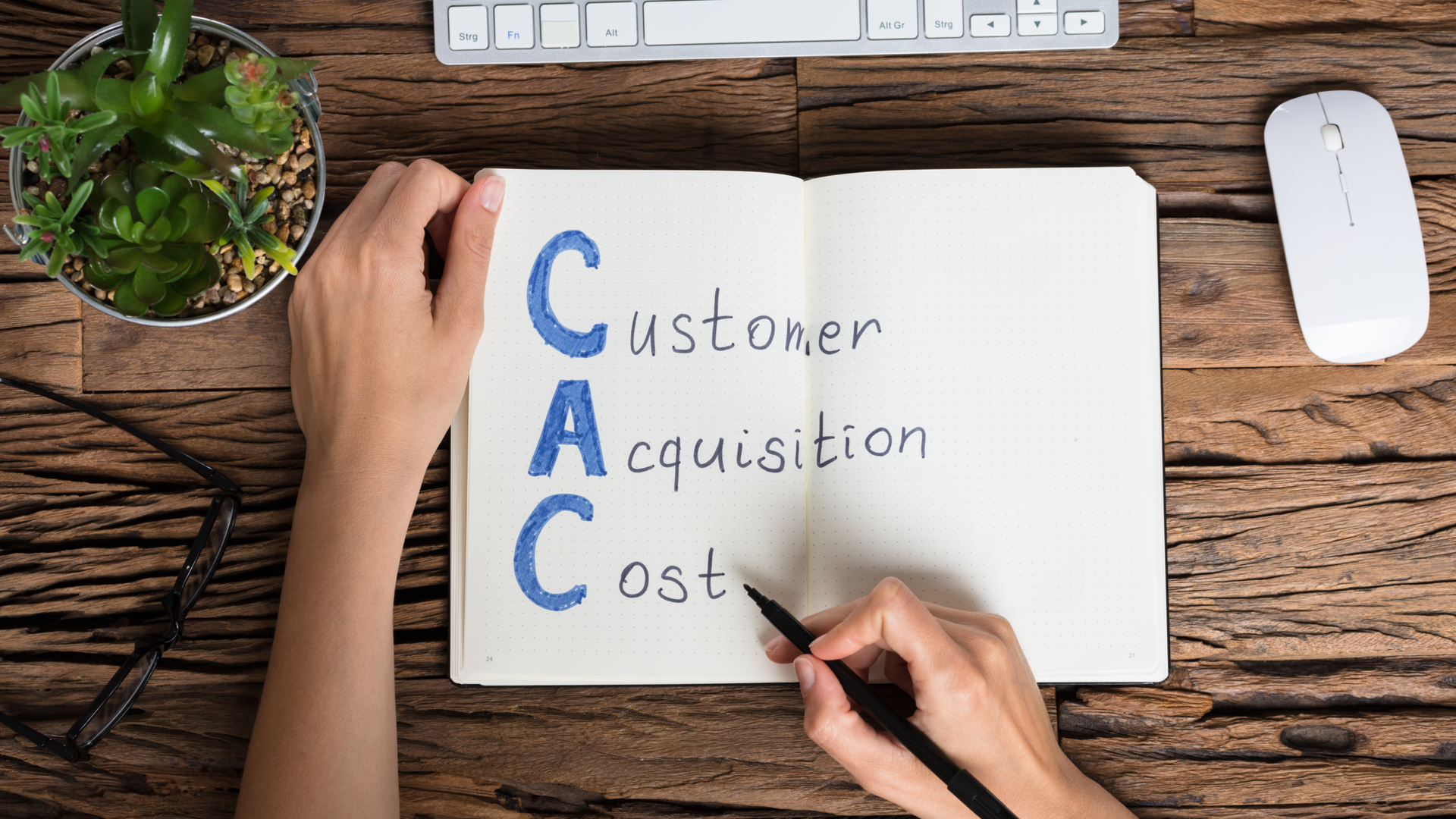

1. Customer Acquisition Cost (CAC)

CAC may be one of the most important marketing metrics for any business, not just for startups. It shows how much you should spend on average to attract a new paying client. The smaller the CAC the better.

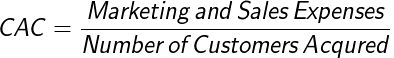

How to calculate CAC

The equation is quite simple – just divide your marketing & sales budget with the number of new customers.

Example:

If you spend $1,000 monthly on user acquisition and attract 10 new clients, your CAC is $100. You can use this numbers for planning your future marketing budget, depending how many clients you wish to acquire the following month. Just be careful, as these numbers can change depending on many factors, such as promotion efficiency, your business being seasonal, and many other external circumstances.

To calculate CAC with the highest accuracy, you also need to take other expenses into account, although they may not always be part of your marketing budget: salaries, tools, equipment, etc.

You can use any time span as a basis for calculation. For example, small retailers can update their numbers every month, as the full client journey is short in their industry – it can take less than an hour from the moment a user sees your ad until the purchase is completed. For B2B companies that can spend months in negotiation, it is wiser to calculate CAC annually.

How to improve your CAC

Simply knowing your CAC won’t give you much, except for an understanding of the general state of your business, of course. But since our goal is to minimize cost, you may want to consider some other factors:

Channels

There are dozens of ways people find your business: via search engines, ads, word of mouth, that huge billboard downtown... Some marketers prefer to categorize these channels as paid and free ones. Paid channels are usually associated with advertising while free channels include all cases when customers interact with your business without being affected by paid promotion, for example by recommendation, search, word-of-mouth etc. Knowing the ratio between the channels will show you how organically does your customer base grow.

There are dozens of ways people find your business: via search engines, ads, word of mouth, that huge billboard downtown... Some marketers prefer to categorize these channels as paid and free ones. Paid channels are usually associated with advertising while free channels include all cases when customers interact with your business without being affected by paid promotion, for example by recommendation, search, word-of-mouth etc. Knowing the ratio between the channels will show you how organically does your customer base grow.

The problem with this method is that free channels are usually not as free as they may seem. For example, you need to invest huge amounts of money and effort in improving your website's content, usability, and reference weight to increase the number of users who find your business on the Internet. You have to expose your message to a number of influencers to make word-of-mouth work. And if you dig deeper, you may realize that many users who arrive via free channels were actually influenced by paid activities before that. Therefore, calling them organic may be a stretch.

Classifying your channels by medium can give you more room to work. For this purpose can use Google Analytics or any other tracking tool. If you use offline lead generation activities, such as cold calls, meetups, or a POS display, you may also want to find a way to track users coming through these sources.

Calculating CAC for each of these channels will give you an understanding as to which one attracts users more effectively. In the future, you may want to allocate more of your budget to this channel.

The customer journey

The customer journey is the path a prospect takes when interacting with your business from introduction to conversion, and even beyond. By measuring conversion at every stage, you'll be able to identify any weak points and fix them.

The customer journey is the path a prospect takes when interacting with your business from introduction to conversion, and even beyond. By measuring conversion at every stage, you'll be able to identify any weak points and fix them.

For example, if your ad gets few if any clicks, then you may be targeting the wrong audience, or your message isn’t catchy enough. If you're getting a lot of clicks but gaining no leads, then the ad may be incongruent with your product or service. Another reason for high churn rate may be technical issues with your website/app, such as an invalid contact form, poor design, errors when transferring requests to your CRM, etc. If you have many leads but no sales, it may be an indication that you are targeting the wrong audience (e.g. attracting poor people when you have premium goods)... or maybe you've hired a sociopath for your sales team... just observe the person in action - cautiously.

Lifetime Value (LTV)

Once you've figured out how much it costs to turn someone into a customer, you need to know how much the person is worth as a customer. This is important for two reasons:

- It helps to evaluate the efficiency of your marketing activities: if it costs $100 to get a client who only spends $50 on your products, that’s bad news for you – there's something wrong with your business model. The sooner you address it, the better. It also shows how much you can afford in CAC. Based on this data, you can plan your marketing budget and activities.

- LTV can also help you assess the quality of your product and customer service; If customers leave too soon, your product may need improvements, or the customers were treated badly.

How to calculate LTV

If yours is a one-time charge model, multiply the average purchase amount by the number of repeat sales within an average retention time.

Example:

If an average buyer brings you profit of $100 per transaction, makes 5 purchases annually, and remains with your brand for 5 years, his LTV is $2550 ($100*5 purchases/year*5 years). Thus, it's ok to spend $500 on acquiring him.

If you are utilizing a subscription- or recurring-revenue model, then multiply an average plan with an average subscription duration.

Example:

If you keep your average client for 12 months, then your annual revenue can be considered your LTV.

How to increase LTV

To maximize the LTV of your customers, you can either increase the average spend or the lifetime (or both)

You can offer your clients special perks and discounts for recurrent or large purchases, provide a good recommendation engine that inspires customers to buy extra items, or simply raise your prices – but be careful, some clients may prefer to abandon your service rather than pay more.

To prolong the lifetime of clients, it is crucial to provide high-quality customer service, as a client may leave in spite of being fully satisfied with your product, if your staff is rude. Don't forget to remind customers about your business with special offers – many use multiple providers, so there's a chance they may have simply forgotten about you.

For this purpose, you can also use gamification tricks, such as “point cards”. For example, award your users special statuses based on their purchasing behavior.

Here's an example from Starbucks. When buying their products, customers win stars that can be redeemed on future purchases. Loyal users also get upgraded to higher levels and get special perks, such as extra coffee, a birthday gift, or individual offers.

Payback Period

Yet another way to find out if your CAC is adequate is to determine the payback period. This is the amount of time it takes for new users to cover their cost of acquisition and eventually start bringing you revenue.

How to calculate the payback period

As with LTV, this depends on your business model.

It is relatively easy to calculate the payback time for subscription models. All you need to do is divide your CAC by the monthly subscription fee.

For one-time charge models, you'll have to measure the number of orders your clients need to place before they become profitable to you.

The payback period can vary drastically between industries. For e-commerce, the first order typically covers the cost of acquisition. For SaaS it can take more than a year to turn your customer into a source of income.

In any case, the longer the payback period, the harder it is to swallow as there's a lesser chance a customer will stay with you for so long.

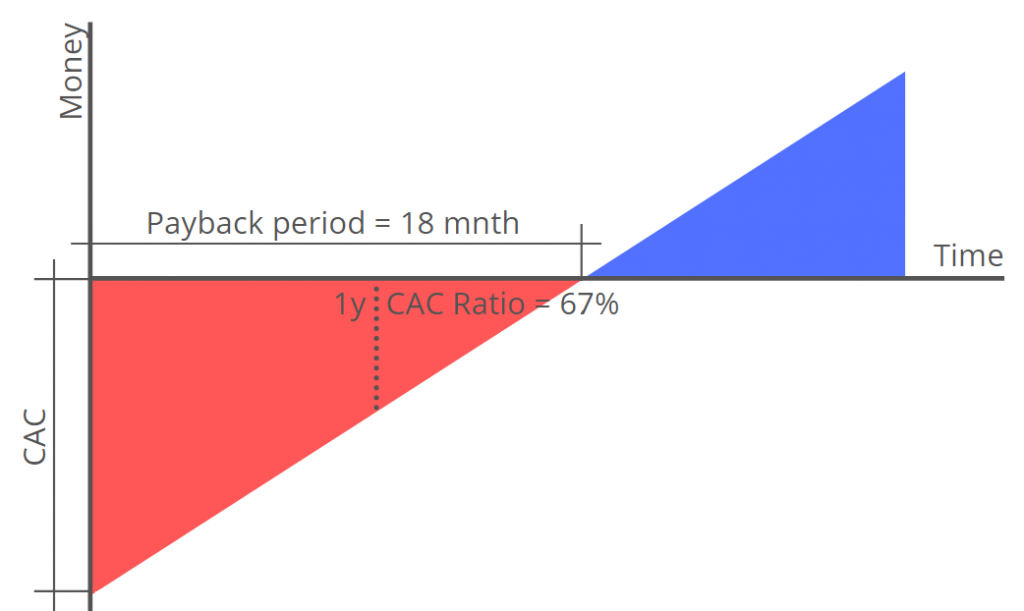

CAC Ratio

CAC ratio is the inverse metric for the payback period and is the percentage of acquisition costs that will be gained back within a year. The chart below will give you a better idea of the interconnection between these indicators:

Example:

If your average CAC (including ads, marketing campaigns, and salaries) is $1,800 and monthly subscription costs $100, then your payback period is 18 months and the CAC ratio is 67%.

How to Shorten the Payback Period?

There is no universal technique to minimize payback time, though there are some things you can try that may affect it:

- Raise organic acquisition through SEO, referrals and word-of-mouth, as organic leads are usually the most interested in your offers and therefore cheaper.

- Automate routine. Relying on chatbots or algorithms for recurring or monotonous tasks may free up your employees to optimize their acquisition activities.

- Upsell your customers. Over time, your customers may become interested in advanced features. Make it easy for them to scale their subscription plans.

- Experiment with your rates. This may help you find the right balance between customer demand and their willingness to pay.

Return on Investment (ROI)

Many marketers consider ROI an important metric in their practice, so it certainly deserves to be mentioned in this guide.

Many marketers consider ROI an important metric in their practice, so it certainly deserves to be mentioned in this guide.

ROI refers to the amount of money you spend on promoting your business compared to the revenue it brings. In other words, it shows how much you gain for every dollar spent.

How to calculate ROI

Depending on the aspects you want to analyze ,there may be different ways to calculate ROI. Here are the two most commonly used methods:

Simple ROI

The most fundamental way to estimate your campaign's ROI is to integrate it into the general business line calculation.

To calculate it, you need to subtract your marketing costs from the sales growth and divide the result by the marketing cost.

![]()

If your sales grew by $5000 while promotion cost $1000, then the simple ROI is 400%.

Campaign Attributable ROI

The simple ROI is easy to calculate, but it is based more on assumption than on real numbers. Sales do not always come from a certain campaign. They may be the result of your sales department’s efforts or word-of-mouth, etc.

So, to gain deeper insight into the impact of your campaign, you may want to compare recent numbers with numbers from the period before the promo was launched.

Having enough historical data, you can extract your organic sales growth from it. This income is not attributed to your marketing activities, so simply subtract it from your overall sales growth. Here's the resulting formula:

![]()

So, if the above-described company has 5% organic sales growth, which is $250, then its ROI drops to 375% ($5,000 - $250 - $1000) / $1000 = 375%)

ROI is not always about sales

Since many companies have a separate department to handle sales, some marketers prefer to count leads instead of customers. For this purpose, you need to determine the value of leads based on your historical conversion rate.

There are also hybrid campaigns, the main purpose of which is to collect non-sales conversions, such as blog subscriptions or signup to a mailing list. To measure an approximate ROI of these campaigns, you'll have to take into account how many of your non-sales leads convert into paying customers over time.

Net Promoter Score (NPS)

NPS measures customer satisfaction as overall client experience. This metric not only shows the loyalty of your audience, it also correlates with business growth.

NPS was introduced by Fred Reichheld, Bain & Company and Satmetrix and is a registered trademark used by two thirds of Fortune 1000 companies.

How to calculate NPS

Run a survey among your customers asking a single question: “On a scale from 1 to 10, how likely are you to recommend our product/service/brand to a friend or colleague?”. Then group the results into 3 categories:

- Promoters (score 9-10) – these people are your brand advocates and fuel your sales growth.

- Passives (score 7-8) – these clients like your business, but they are less likely to promote your brand and may possibly to shift to your competitors.

- Detractors (score 0-6) – these are unhappy customers leaving bad reviews and spreading negative word-of-mouth. They can slow down and endanger your business growth.

To calculate NPS, subtract the percentage of Detractors from the percentage of Promoters and divide the result by the number of people participating in the survey.

Example:

Let's say you surveyed 100 people. The results were as follows:

Detractors: 10 people

Passives: 20 people

Promoters: 70 people

In this case, your NPS equals 60% (70-10/100*100%), which is an excellent outcome.

Your results can vary between -100 (everyone hates you) and 100 (everyone loves you). An NPS of 50 is considered good, and scores above 70 are exceptional. If your customer loyalty is that high, it will be much easier for you to raise capital.

How to increase NPS

Many experts criticize this metric, as the score provides little information in the long perspective. Therefore, you should not just divide your customers into fans and haters, you should also ask for feedback. For example, you can ask people why they would or would not recommend your business to other people or what can you do to make them happier with your brand.

It is also good practice to do recurring NPS measurements, as a client's opinion can change over time.

***

In our modern era when most acquisition is done online, it's critical for every business to have a good website, a bug-free and easy-to-use application, and an impactful design. When these are done professionally they can raise conversions and sales many-fold.

We at Intersog will be happy to give you a hand in any task from website development to UI/UX design and QA services. Contact us to learn more about our solutions.

And, of course, subscribe to our newsletter, because you won’t want to miss part 4.

←PREVIOUS Ultimate Guide to Evaluating Your Startup. Part 2: Users

NEXT: Ultimate Guide to Evaluating Your Startup. Part 4: Sales

Leave a Comment