Fundraising is somewhat like proposing or being interviewed for a US visa: most candidates only hear "yes" or "no", while the reasons for the answer often remain concealed.

In order to help you gain a clearer understanding of the process, we've put together the factors that influence an investor's decision the most. When millions are on the stake, a venture capitalist should be able to evaluate a potential partner from every angle. One article is definitely not enough to cover all the features, so we've decided to make a series of articles each dedicated to a separate domain.

This one will be devoted to financing, which is usually a major indicator of a company's success for many investors.

Evaluating your startup's financial health

Finances are a key metric for any business. It's not a secret that sometimes VCs put money into profitable businesses only to get positive cash flow and an attractive annual report of earnings. Essentially, their own financial prosperity usually depends on the results of their partners.

A plethora of metrics plays a role in judging startups. Today we'll review the most popular ones:

We hope you’ll find this short accounting tutorial useful for further developing your business.

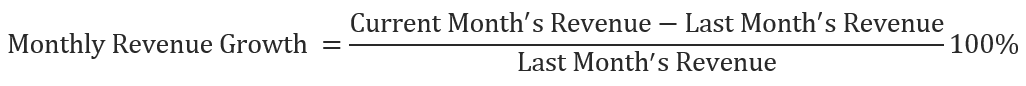

Monthly/Quarterly Revenue Growth

Monthly/Quarterly revenue growth is a rise in a company's earnings as compared to a previous period. It can be analyzed either on a yearly basis or sequentially.

To derive the monthly revenue growth, subtract your latest month’s revenue from the current month’s indicators, and then divide the remainder by last month’s numbers.

The same method is used to calculate quarterly rates.

Uses:

This indicator is more commonly used by startuppers than VCs. The key reason is that it shows proportion (which is usually attractive) without showing magnitude (which matters more in a long run).

Therefore, when evaluating a company, investors are more likely to measure the growth rates for a multi-year period, as that gives a clearer picture of a company's performance.

Example:

Company X generated $58.7 million in revenue for the 1st quarter of 2018 and $66.2 million for the 2nd quarter. Accordingly, the firm's quarterly revenue growth has reached 12.78%. If the company continues at such a pace, it will become a great investment.

Risks and limitations:

1) Short period shows nothing

A company’s performance can vary dramatically with business cycles, market trends, or any internal transformations. Seasonal companies like those acting in tourist or gift industries might have poor indicators at certain periods and large revenue boosts at other times.

A company’s performance can vary dramatically with business cycles, market trends, or any internal transformations. Seasonal companies like those acting in tourist or gift industries might have poor indicators at certain periods and large revenue boosts at other times.

2) Size matters

If your last month's revenue was $300, to get an attractive 50% growth rate, you only need to raise your sales to $450, which might only be a few customers. However, if you run a multimillion-dollar business, you'll need to try like hell to reach the same increase.

If your last month's revenue was $300, to get an attractive 50% growth rate, you only need to raise your sales to $450, which might only be a few customers. However, if you run a multimillion-dollar business, you'll need to try like hell to reach the same increase.

Run Rate

The run rate is primarily used to predict the future performance of a startup based on the actual state of affairs. You can calculate it by multiplying the most recent month’s revenue by 12 (you can also calculate it by quarters).

Uses:

Run rate is widely used to estimate the performance of newly emerged companies, recently formed departments, or businesses undergoing significant changes in key operations. In other words, this metric is helpful when you lack the historical data to project the future revenue more precisely.

Since most early-stage startups are planning to raise further investments, VCs analyze such businesses by taking into an account the possible position of the company in 18–24 months, when the next funding stage will happen. Derived numbers allow them to assume whether series B or C investors are likely to notice the company, which enables them to determine whether or not the next stage is likely to happen.

Example:

If your company made $10M in the latest quarter, you can state that, based on the latest quarter, your enterprise is operating at a $40M run rate.

Risks and limitations:

The run rate is a tricky metric, especially in cases that involve intermittent growth.

Seasonal businesses

For example, if you own an app for ski-fans, it would be wrong to calculate the run rate based on the winter holiday season.

For example, if you own an app for ski-fans, it would be wrong to calculate the run rate based on the winter holiday season.

Circumstantial changes

This principle can be vividly illustrated by such companies as Apple, where sales volume increases massively with a new product release. Numbers based on these periods have little to do with reality.

This principle can be vividly illustrated by such companies as Apple, where sales volume increases massively with a new product release. Numbers based on these periods have little to do with reality.

Anomalous purchases

If you are lucky enough to make a large one-time sale with pre-payment and flexible delivery terms, this can cause your numbers to blast, leaving nothing from the realistic projection.

If you are lucky enough to make a large one-time sale with pre-payment and flexible delivery terms, this can cause your numbers to blast, leaving nothing from the realistic projection.

Profit Margins

Let's face it, the main decision-making factor for any investor is a startup’s ability to pay a dividend. To assess that, they should analyze numerous aspects of a company's profitability, starting from how much income it produces from resources used. Calculating profit margins allows them to gain a deeper understanding of how efficiently a business handles money.

The 3 most frequently used profit margin ratios:

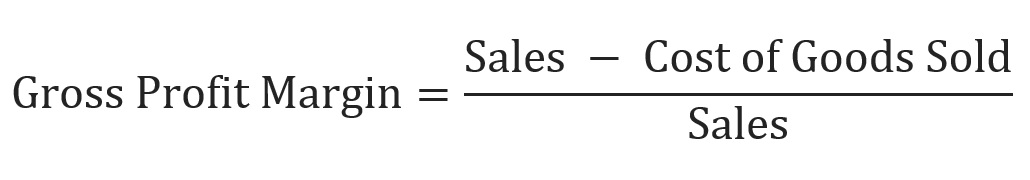

1. Gross Profit Margin

The gross profit margin shows the profit a startup gets on its cost of sales. It demonstrates how efficiently the workforce and supplies are used in operation.

High gross margins mean that you'll have more money to invest in R&D, marketing, or other domains not directly associated with sales. On the other hand, a downward trend over a long period is a strong indication of future financial problems.

High gross margins mean that you'll have more money to invest in R&D, marketing, or other domains not directly associated with sales. On the other hand, a downward trend over a long period is a strong indication of future financial problems.

It's also worth noting that gross profit margins can vary from one industry to another. For example, software companies can reach margins of up to 70%, while hardware businesses rarely manage to reach 40%.

2. Operating Profit Margin

We can obtain the operating profit margin by dividing earnings before interest and taxes (EBIT) by sales. By eliminating variables such as tax burden and capitalization leverage, this metric gives an increased insight into a company's potential profitability.

If an investor considers buying out a startup, its earning potential is more important than its capital structure.

The operating profit margin is useful for comparing firms acting in different tax settings or applying various strategies for financing themselves by focusing on the core issue: how good are these companies at making money.

It also shows how much cash a company throws off. Many investors prefer this characteristic to net margin because it is harder for accountants to manipulate it.

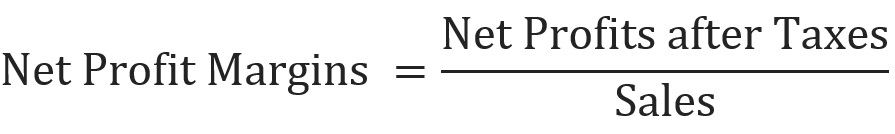

3. Net Profit Margin

Net profit margin or the bottom line, as it is frequently called, illustrates the amount of net income produced from revenue. It takes into account all business expenditures, including the cost of goods sold, operational costs, interest, dividends, taxes, various one-time expenses, etc.

Net profit margin is a crucial indicator of your financial health. Businesses with high net profit margins have a greater chance of survival during the hard times. They may even be able to grow their market share during these periods, as some of their less successful competitors may quit the game.

Like the other margins, net profit margin may vary depending on the industry. While software businesses have one of the highest gross margins, their net profit margins are significantly lower. That's because sales and operating costs are quite low in this sector, while marketing and administration activities may cost a pretty penny.

Example:

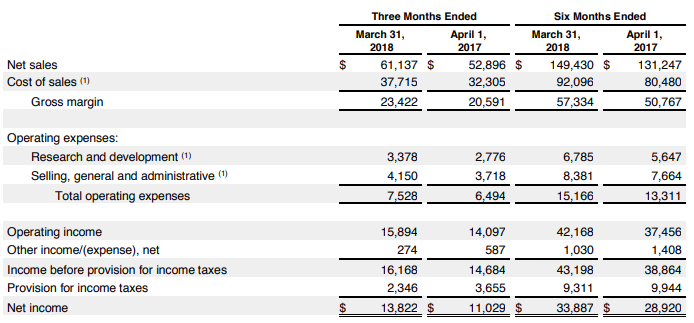

Let's have a look at Apple's income statement:

Their gross profit margin was 38% or (($61B - $37.7B) ÷ $61B) x 100, while their net profit margin has only reached 23% or ($13.8 billion ÷ $61 billion) x 100. In other words, they keep $.23 from each dollar earned.

Burn Rate

Burn rate is an indicator of negative cash flow. In other words, it explains how quickly a business spends its venture capital to cover overhead costs before it starts gaining revenue. It’s usually specified in cash spent per month.

Burn rate is also applied to determine a startup's runway, which is the time before it runs out of money.

These numbers tell an investor if a business is self-sustaining or if it requires further infusions of capital.

Gross Burn vs. Net Burn

Gross burn shows the total amount of a company’s monthly spending, while the net burn is money it actually loses.

Example:

If a tech startup spends $30K a month on salaries, rent, servers, and other staff but makes $10K in revenue, its gross burn would be $30K, while the net burn is only $20K.

It's an important distinction, as it can substantially affect the runway time. For example, if the same startup had $120K in stock, it would take six months instead of four to run out of funds. Most VCs expect their money to be consumed within 18–30 months.

If the burn rate increases over forecasts without substantial changes in revenue, an investor can demand the burn rate to be decreased. This often leads to labor shedding.

Sum Up

Finance is only one of many dimensions of early-stage startup success, but there’s no investor who won’t pay attention to your attitude toward budgeting.

At Intersog, we aim to help newly emerged software companies gain top performance without putting their financial health in danger. Contact us to learn more about our software development services and workforce solutions or use our calculator tool to figure the cost of your dream team.

Found this article exciting? Feel free to proceed to Part 2: Users and Part 3: Marketing

Sources of information:

Investopedia (We would also recommend this resource for comprehensive explanation videos.)

TechCrunch

Apple.com - Q2_FY18_Consolidated_Financial_Statements.pdf

NEXT: Ultimate Guide to Evaluating Your Startup. Part 2: Users

Leave a Comment