The world is changing rapidly as everything becomes more digital. No industry is immune, including banking. Today, people want the same ease and accessibility from their banks that they get from other online services. To keep up and stay competitive, banks must go digital.

But digital transformation isn't just about new technology. It's about rethinking how banking works and making it more customer-centric. By going digital, banks can make their operations smoother, improve security, and deliver services that meet customers' needs in real time, wherever they are.

It is an exciting time for the banking industry. We're eager to share our insights on digital transformation in banking, including what's driving it, the technologies behind it, and the key trends to watch. We hope you enjoy reading.

What is Digital Transformation?

Digital transformation is revolutionizing the way businesses operate and communicate. Organizations across industries are adopting advanced technologies to drive innovation and improve customer engagement.

Take retail, for example. The shift to e-commerce has led retailers to leverage technologies such as AI, big data, and IoT to create personalized shopping experiences and streamline their supply chains.

Healthcare is seeing massive adoption of electronic health records, telemedicine, and wearable tech, all of which make it more personalized and accessible.

The transportation sector has seen major changes with the emergence of ride-sharing platforms and the growing presence of electric vehicles, introducing innovative models such as battery swapping and vehicle-to-grid systems.

Ultimately, digital transformation is creating new opportunities, increasing efficiency, and improving the customer experience. As technology advances and consumer demands increase, its influence will continue to reshape industries, including finance.

Digital Transformation in Financial Services

The financial sector is undergoing a significant overhaul, driven by digitalization. Cutting-edge technologies, such as blockchain and smart contracts, are paving the way for innovative financial solutions that are disrupting traditional banking. These new tools offer unprecedented levels of efficiency, security, and convenience that far exceed the capabilities of legacy systems.

This shift began with the rise of alternative financial platforms, including both centralized and decentralized crypto exchanges and NFT marketplaces. As these innovations gained traction, traditional financial institutions recognized their potential and growing consumer demand, prompting them to integrate these technologies to remain competitive. This wave of digital transformation is ushering the financial sector into a new era, forcing even the most established institutions to adapt.

Challenges of the Transition from Traditional to Digital Banking

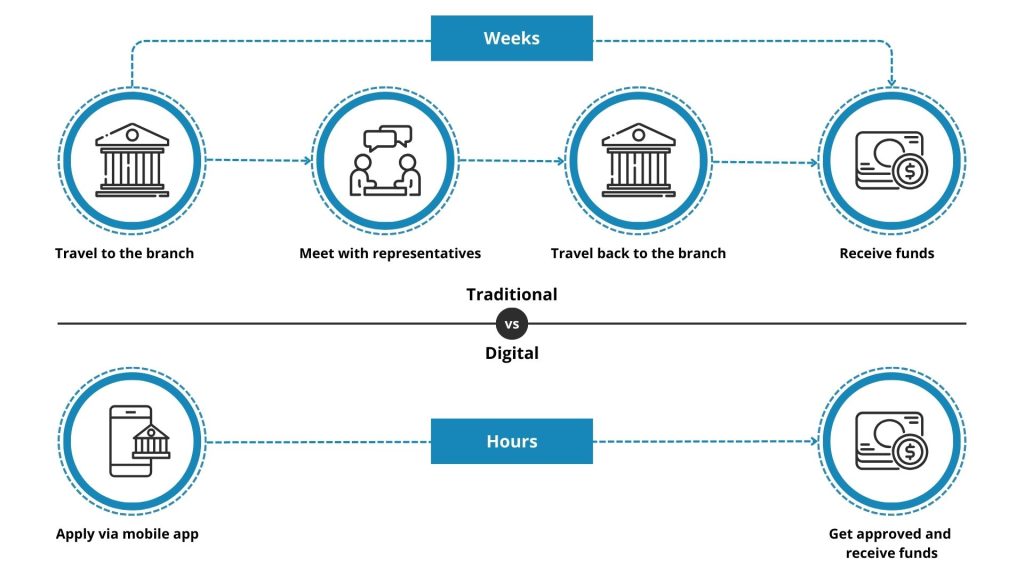

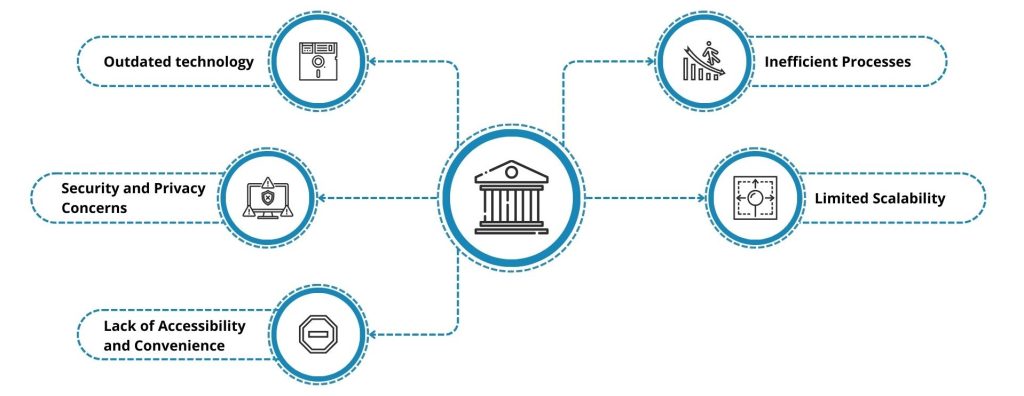

In today's fast-paced digital world, traditional financial institutions are under increasing pressure to modernize their systems to meet customer demands and remain competitive. While the shift to digital banking offers significant opportunities, it also presents several challenges:

- Outdated technology: Many traditional banks rely on legacy systems that struggle to keep up with the rapid pace of change in the financial industry. These outdated systems can result in poor integration with new services, slow the introduction of new features, and limit the ability to manage diverse assets.

- Security and privacy concerns: Ensuring the security and privacy of customer financial information is critical. However, legacy banking systems are often more vulnerable to cyberattacks and data breaches, putting sensitive information at risk.

- Lack of accessibility and convenience: Traditional banks often fall short when it comes to providing easy access to financial information from remote locations. The cumbersome processes involved in accessing services can frustrate customers who expect quick and convenient solutions.

- Inefficient processes: Traditional banking is often plagued by inefficiencies such as long wait times, manual processes, and a lack of transparency. These issues can lead to a poor customer experience and higher operating costs.

- Limited scalability: Scaling operations in traditional banking systems can be challenging, resulting in higher costs and lower efficiency. It also hinders the ability to enter new markets and offer innovative services to customers.Overcoming these challenges is crucial for traditional financial institutions as they navigate the transition to digital banking.

Benefits of Digital Transformation for Traditional Banks

Despite the rise of digital-only financial services, traditional banks have key strengths that can be leveraged to drive their digital transformation. Here's how these advantages can help them thrive in a digital-first world:

Extensive customer base: Incumbent banks have spent years building a broad and loyal customer base, giving them access to a wealth of sensitive data, such as personal identification and insurance information. This data, combined with the trust they've earned, gives traditional banks a significant advantage as they pivot to digital.

Regulatory stability and trust: With a long history of operating under established regulatory frameworks, traditional banks face fewer restrictions on data collection and processing than digital newcomers. Their reputation and regulatory compliance provide a secure foundation for embracing digital transformation while maintaining trust and reliability.

Efficient adoption of new technologies: Traditional banks often have the financial resources to attract top talent, allowing them to upgrade their systems and seamlessly adopt new technologies. This facilitates smooth integration with government and third-party platforms, ensuring a streamlined and compliant experience for customers.

Enhanced wealth management: Through digital transformation, traditional banks can offer a mix of classic and innovative asset management solutions, all with increased security and flexibility. This allows them to offer competitive rates, reduced fees and guaranteed returns, enhancing the overall customer experience.

Emerging Trends in Digital Banking Transformation

To remain competitive in today's rapidly evolving digital landscape, banks must rethink their value proposition by improving the customer experience and leveraging data for greater value. This requires focusing on several core areas based on their strengths and resources, while building digital platforms that support customers at every stage of their journey, from initial research to long-term management. Here are some of the trends driving the future of digital banking:

Simplify everyday banking: Banks should develop platforms that integrate effortlessly into customers' daily activities, making transactions faster and more convenient. By embedding financial services into routine tasks, such as shopping or paying bills, banks can streamline processes and reduce the time customers spend managing their finances.

Holistic solutions for major life events: When customers face major life decisions, such as buying a home or planning for significant life changes, banks should offer platforms that provide comprehensive support from start to finish. Partnering with relevant companies to help with everything from the initial search to financing and ongoing management can position banks as trusted allies in navigating these important moments.

Customized wealth and asset protection services: In wealth management, banks must leverage customer data to provide personalized investment and advisory services. Advanced data analytics can help banks provide customized advice that enables customers to make strategic decisions about growing and protecting their wealth over time, creating a valuable competitive advantage through personalized service.

Check out a related article:

The Match Made in Heaven: 9 Examples of Using AI in FinTech

Key Drivers Behind the Digital Transformation of Banking

The banking industry is undergoing a radical transformation due to rapid technological advancements and evolving customer expectations. To remain competitive, banks must adopt digital strategies and leverage emerging technologies to improve user experiences and extract value from data. Here are the key forces driving this transformation:

Shift to mobile banking

The widespread adoption of smartphones has placed mobile banking at the forefront of the industry's digital transformation. Customers now expect seamless access to their financial services anytime, anywhere. Mobile banking apps provide quick and convenient solutions, improving user engagement while enabling banks to collect and analyze valuable data. The development of "super apps" that consolidate multiple services further underscores the importance of mobile apps development in today's financial landscape.

Customer-centric strategy

For successful digital transformation, banks must put customers at the center of their operations. By focusing on collecting and analyzing customer data, banks can offer personalized and relevant services that address individual needs. This customer-centric approach ensures a consistent and satisfying experience across all platforms, driving greater loyalty and retention.

Ongoing digital evolution

Digital transformation is an ongoing process, not a one-time initiative. Banks must remain agile, constantly evolving their digital offerings and adapting to new technologies and consumer demands. To keep pace, they must frequently update their technology infrastructure, digital strategies and operating models to stay relevant in a competitive marketplace.

Infrastructure Modernization

Investing in modernized infrastructure is critical to supporting banks' digital operations. By upgrading aging hardware and software and implementing scalable network solutions, banks can improve security and deliver smoother, more efficient services. Strong cybersecurity measures are also critical to protect sensitive customer data and ensure secure digital transactions.

Rethinking traditional operating models

The digital era requires banks to rethink their existing operating models. Streamlining workflows, integrating advanced systems, and restructuring teams are critical steps in aligning operations with digital strategies. In addition, banks must ensure that their workforce is equipped with the necessary skills to navigate this new digital landscape.

Data-driven insights

Data has emerged as one of the most valuable assets for banks in their digital transformation journey. By analyzing customer data, banks can gain critical insights into behaviors and preferences to improve decision making and service personalization. The use of AI, machine learning, and data analytics enables banks to identify patterns, automate processes, and deliver customized financial solutions.

Rise of a Fully Digital Market

The shift to a fully digital marketplace is reshaping customer expectations for banking. Today's consumers demand instant access to financial services through their devices, whether they're managing accounts, making payments, or investing. To remain competitive, banks must embrace this digital shift by offering a full suite of digital services that provide a secure, convenient, and frictionless experience for their customers.

Digital Technologies Utilized by Modern Banks

Today's banks are using cutting-edge technologies not only to improve their operations, but also to transform their business models. These innovations are driving greater efficiency, improving the customer experience, and opening doors for future growth. Here's how key technologies are being used in banking:

Robotic process automation (RPA): Banks are increasingly using RPA to automate routine tasks such as data entry, account reconciliation, and customer support. This automation frees up human resources to focus on more strategic and complex activities. The adoption of RPA results in increased efficiency, reduced errors, and lower costs, ultimately improving the customer experience. For example, BNP Paribas is using RPA to streamline its back-office functions, enabling faster transaction processing.

Biometrics: Biometric solutions, including facial recognition and fingerprint scanning, are gaining traction in banking as a way to enhance both security and convenience. By using biometrics to authenticate customers, banks can reduce the risk of fraud and speed up processes. JPMorgan Chase, for example, allows users to securely access accounts using facial recognition or fingerprint technology, providing a seamless banking experience.

Mobile and embedded devices: Mobile technology and embedded systems have transformed the way customers interact with financial services. Through mobile banking apps, digital wallets and smart devices, banks are delivering secure, accessible services while increasing customer engagement. These tools are also introducing new models such as mobile payments and P2P transfers, making banking more convenient and integrated into everyday life.

Artificial intelligence & Machine learning: AI and machine learning help banks analyze large data sets, automate various operations, and provide personalized services. These technologies are improving areas such as fraud detection, credit scoring, and customer interactions. For example, Citigroup uses AI-powered virtual advisors to provide personalized investment advice, enabling customers to make informed financial decisions.

Big data management and analytics: The ability to collect and analyze large amounts of data is becoming essential in banking. By leveraging data from disparate sources - such as transactions and social media - banks can gain insights into customer behavior, refine marketing strategies, and detect fraud more effectively. HSBC, for example, is using big data to improve customer segmentation, resulting in more targeted marketing and higher engagement.

Cloud technology: Cloud computing is transforming banks by enabling them to move from rigid, legacy systems to more agile, scalable platforms. By using cloud solutions to store data, run applications and deliver services, banks can quickly adapt to changing customer demands and reduce operational costs. Goldman Sachs, for example, has embraced cloud technology to modernize its IT systems, improve security, and streamline operations.

Blockchain technology: Blockchain technology is revolutionizing banking by ensuring secure, transparent, and immutable transactions. This decentralized system eliminates intermediaries, reduces transaction costs, and speeds up processes, especially for cross-border payments. Institutions such as JPMorgan Chase are using blockchain to create new products, such as digital currencies, and to build more efficient blockchain-based payment platforms.

The bottom line

The banking industry, once known for its conservative approach, is undergoing a profound transformation driven by modern technologies. These advancements are revolutionizing operations while unlocking new opportunities for growth. As banks continue to adopt these digital solutions, those that fail to embrace this shift risk being left behind in an increasingly competitive market.

For those seeking to stay ahead in the digital age, Intersog offers expert fintech software development. From AI to blockchain, we deliver tailored solutions to drive your digital transformation. Contact us today to build the future of banking.

Leave a Comment