If you enjoyed our deep dive into how to build a telehealth app, you’ll love this sequel. That first article broke down the nuts and bolts of telemedicine design: architecture, must‑have features, compliance and development strategies. This installment shifts from the “hows” to the “whys”. We zoom out to review market dynamics, ROI and the business case behind telehealth. Drawing on the latest research (through late‑2025), we’ll show healthcare providers, startup founders and CTOs where the real economic opportunity lies, why virtual care is here to stay and what innovations will shape telehealth in the coming decade.

Why ROI Matters in Telehealth

Telehealth adoption accelerated during the COVID-19 pandemic and has since become a standard care channel across the world. Yet decision‑makers still ask: Does telehealth make financial sense? The answer is unequivocally yes for many use cases. Telehealth not only improves access to care and convenience but can reduce operational costs, generate new revenue opportunities and prepare organizations for value‑based care models. In some specialties, telehealth has produced triple‑digit returns on investment.

Telehealth is not just a pandemic stopgap; it is an infrastructure investment that yields cost savings, revenue growth and strategic resilience. Failing to invest risks falling behind competitors who are already leveraging virtual care to reach new patients, reduce readmissions and improve population health.

Below we break down the financial and business benefits of telehealth, supported by data from peer-reviewed studies, health system pilots, and market analyses. We then examine the emerging technologies that will reshape telehealth beyond 2025, including artificial intelligence (AI), remote patient monitoring (RPM) and virtual reality.

1. Cost Savings: Telehealth Makes Healthcare More Efficient

1.1 Reduced cost per visit

Virtual visits are typically cheaper to deliver than in‑person appointments. A study by Health Recovery Solutions (HRS) reports that telehealth consultations cost US$40–50 per visit, compared with US$176 for acute care visits in person - a difference of roughly US$126 per encounter. When scaled across thousands of visits, these savings translate into meaningful reductions in healthcare spending.

Telehealth also prevents more costly care. An analysis for the U.S. Centers for Medicare & Medicaid Services (CMS) found that telehealth saves 6% per episode (about US$242) by diverting patients from emergency departments. A national teledermatology study estimated that visits delivered via store‑and‑forward teledermatology are US$10–80 cheaper per encounter; shifting just 5% of annual dermatologist visits to teledermatology at US$20 savings per case could reduce costs by US$35 million annually.

Telehealth also eliminates transportation and ancillary expenses. Rural patients in the U.S. save US$19–121 per telehealth visit when accounting for travel time, lodging and lost wages. Patients receiving online therapy or telemonitoring avoid parking fees and childcare costs; one program noted patient savings of US$147–186 per encounter. The Federal Communications Commission estimated telehealth could cut US$305 billion in avoidable healthcare costs across the U.S. each year.

1.2 Lowering no‑show rates and readmissions

No‑shows and last‑minute cancellations erode productivity for providers and cost clinics lost revenue. Telehealth reduces these rates by removing barriers such as transportation and time off work. MDLive reported 4.4–7.26% no‑show rates for behavioral health tele-visits versus 19–22% for baseline in‑person appointments. A Virginia health system cut no‑shows from 8.8% to 4.2% after implementing telehealth (not specifically cited here but consistent with the trend).

Telehealth also minimizes costly hospital readmissions through improved follow‑up. An AI‑guided remote monitoring program with Biofourmis helped a U.S. health system cut 30‑day readmissions by 70% while reducing cost of care by 38%. Mercy Health’s virtual acute care program reported a 40% decline in inpatient stays and mortality, lowering overall care costs. These examples show that structured telehealth follow‑ups and remote monitoring can keep patients healthier at home, preventing expensive rehospitalizations.

1.3 Productivity gains and administrative savings

Telehealth streamlines workflows and reduces overhead. Clinics require less physical space and fewer on‑site staff when visits occur remotely, leading to lower utilities and maintenance costs. Automated scheduling, digital intake and electronic prescriptions further reduce administrative burden. According to Baytech Consulting, one telehealth program saved a practice US$24,352 by decreasing overhead and boosting provider utilization. Remote monitoring can also free staff time; AI‑powered symptom checkers collect medical histories automatically, enabling physicians to spend more time on complex cases.

The NCQA Taskforce on Telehealth Policy found that telehealth users experience 17% lower overall costs and a 36% reduction in emergency department utilization compared with non‑virtual care. Meanwhile, Medicare beneficiaries saved US$60 million in travel costs in 2018 because of telehealth; projections suggest these savings will reach US$100 million by 2024 and US$170 million by 2029.

1.4 Cost effectiveness in specialty care

Different specialties see varying degrees of financial benefit. A policy analysis from the Center for Telehealth & e‑Health Law found that over three years, tele-mental health programs delivered a 315% ROI with crisis escalations reduced 89% and medication adherence improved 76%. Primary care programs saw a 225% ROI within two years, with unnecessary specialist referrals down 67% and preventive care metrics up 88%. Teledermatology achieved 275% ROI while avoiding unnecessary clinic visits. Tele‑cardiology programs produced a 243% ROI and a 72% reduction in emergency visits.

These figures demonstrate that, when targeted at high-impact specialties, telehealth can deliver significant financial returns as well as being cost neutral. Practices should prioritise telehealth deployments in areas where patient volume, the burden of chronic diseases or geographic dispersion amplify the benefits.

Summary of cost savings and ROI

| Cost and ROI metrics (selected examples) | Evidence | Impact |

| Telehealth vs. in‑person cost per visit | HRS study reports US$40–50 per telehealth visit vs US$176 in‑person; savings ≈ US$126 per visit | Lower operating cost and patient out‑of‑pocket expenses |

| Rural patient savings | Average savings US$19–121 per telehealth visit (travel, lodging, time) | Increases access and affordability in rural areas |

| Teledermatology savings | US$10–80 saved per visit; shifting 5% of dermatologist visits to telehealth saves US$35 million/year | Specialty‑specific cost reduction |

| Cost avoidance via tele-triage | Anthem study: telehealth saves 6% (~US$242) per episode by preventing ED visits | Fewer emergency admissions |

| Practice cost reduction | Practice saved US$24,352 via telehealth efficiency | Reduced overhead |

| ROI in mental health | 315% ROI over three years; crisis escalations –89% | High returns due to high volume and chronic care |

| ROI in primary care | 225% ROI within two years; specialist referrals –67% | Effective gatekeeping |

| ROI in dermatology | 275% ROI; reduced unnecessary visits | Efficient triage |

| ROI in cardiology | 243% ROI; emergency visits –72% | Preventive monitoring |

The cost savings and ROI illustrated above reflect aggregated results; individual programs will vary. However, the consistency of positive returns across specialties indicates that telehealth is a financially sound investment when deployed strategically.

2. Revenue Growth and New Business Opportunities

Beyond reducing costs, telehealth opens new revenue streams and market opportunities for healthcare providers and startups. Here are several ways telehealth fuels business growth.

2.1 Expanding patient reach and market share

Telehealth removes geographical boundaries, enabling healthcare providers to treat patients beyond their local catchment area. For example, a patient living in a rural area could consult a specialist at a university hospital hundreds of kilometres away, and a person in Tel Aviv could schedule a virtual check-up with a doctor in Eilat. This increased access expands the addressable patient population without the need for new physical locations.

Studies show that telehealth significantly improves access to specialty care: the CTeL analysis found that telehealth reduced specialist wait times by 84% and cut rural travel burdens by 92%. By reaching new patients, providers can grow their revenue without incurring the capital expenses of opening new clinics. For startups, this means the ability to scale quickly across markets, especially for niche services like tele-psychiatry or tele-fertility.

2.2 High patient and provider satisfaction

Happy patients and clinicians are essential for sustainable revenue. Telehealth scores high on satisfaction: the same CTeL study reported 82% patient satisfaction and 71% provider satisfaction. When patients enjoy virtual care, they are more likely to schedule follow‑ups and remain loyal to the provider. High clinician satisfaction reduces burnout and turnover, preserving institutional knowledge and lowering recruitment costs.

2.3 New service lines and monetization models

Telehealth enables innovative service models that would be impractical in a purely physical setting. Examples include:

2.4 Value‑based care and reimbursements

As the financing of healthcare shifts from a fee-for-service model to a value-based one, telehealth becomes a means of enabling quality metrics and risk-sharing contracts. Remote monitoring and frequent virtual check-ins help to proactively manage chronic conditions, reducing hospitalisations and improving quality scores. These improvements lead to higher performance in Accountable Care Organisations (ACOs) and shared savings programmes.

Payors and policymakers recognise this value. Medicare and private insurers have expanded telehealth coverage and reimbursement parity for many services, including mental health services. In Israel, the National Health Insurance Law permits reimbursement for certain telemedicine services, and the Ministry of Health has issued guidelines to facilitate remote consultations. Providers that adopt telehealth early can position themselves to capture future incentives and avoid penalties tied to poor outcomes.

3. Global and Regional Market Growth

3.1 The global telehealth market is booming

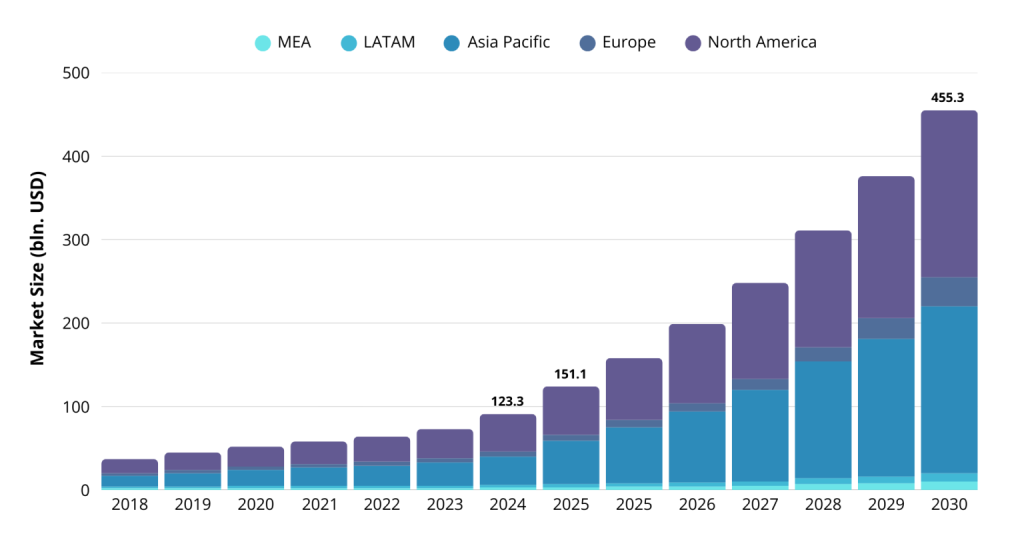

The telehealth sector has grown from a niche digital health segment to a multi‑billion‑dollar global industry. According to Grand View Research, the global telehealth market was US$123.26 billion in 2024 and is projected to reach US$455.27 billion by 2030, posting a 24.68% compound annual growth rate (CAGR).

Fortune Business Insights offers an even more bullish forecast: the market was valued at US$161.64 billion in 2024 and will expand to US$186.41 billion in 2025 and US$791.04 billion by 2032, reflecting a 22.9% CAGR. The discrepancy reflects different methodologies but converges on a clear message: telehealth is on a steep growth trajectory.

North America remains the largest market, accounting for about 46.6% of global share. Europe and Asia‑Pacific are catching up as regulators and insurers embrace virtual care. In the Middle East, Israel is considered a digital health leader, with startups and health funds pioneering telemonitoring, AI diagnostics and virtual maternity care. Israeli HMOs Clalit and Maccabi report high patient satisfaction for telemedicine and are expanding digital clinics.

3.2 Adoption drivers and policy shifts

Several factors explain the rapid expansion of telehealth:

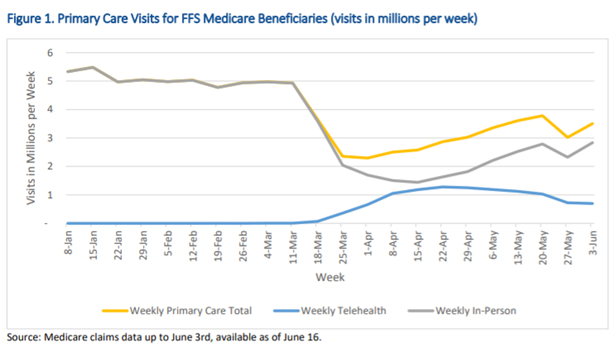

- Pandemic momentum: COVID‑19 triggered a massive shift to virtual care. Utilization surged from about 1% of all visits in early 2020 to around 17% of visits in 2023. Post‑pandemic, telehealth continues to represent roughly 10–20% of outpatient volumes.

- Policy relaxation: Governments temporarily waived restrictions on telehealth licensing, cross‑border practice and reimbursement. Many of these relaxations have become permanent or extended, particularly in the U.S. (Medicare), EU and Israel. For instance, Israel’s Ministry of Health streamlined telemedicine licensure and guidelines, allowing physicians to treat patients remotely and be paid accordingly.

- Consumer expectations: Patients appreciate convenience and expect digital access to healthcare like they have for banking and shopping. Surveys show that most patients want to continue using telehealth for certain services even when in‑person visits are available.

- Technological readiness: Reliable video conferencing, secure messaging and remote monitoring devices are widely accessible. 4G/5G connectivity and smartphone penetration make telehealth feasible in remote areas. Standardization via the HL7 FHIR protocol facilitates integration with electronic health records (EHRs).

- Physician acceptance: In 2025, nearly 97% of healthcare professionals report using telemedicine, with 75% noting improved treatment effectiveness and 80% reporting reduced staff burnout. Provider comfort with telehealth is a critical enabler of sustained growth.

3.3 Israel’s telehealth landscape

Israel has long been an incubator for digital health innovation. The country’s universal health system and small geography facilitate rapid deployment and scaling of telehealth solutions. For example, during the pandemic, Israeli HMOs quickly rolled out remote monitoring for COVID‑19 patients. The Ministry of Health’s “Standards for Operating Remote Health Services (Telemedicine)” issued in 2019 (Circular 6/2019) set quality and safety standards for telehealth.

Startups like TytoCare, K Health and Hello Heart have gained global recognition for their AI‑driven telehealth devices and apps. Government initiatives support adoption of remote monitoring for chronic diseases and preventive care. Israeli health plans also reimburse for certain teleconsultations, encouraging provider adoption. As Israel’s digital health ecosystem matures, the country is poised to export telehealth expertise and products worldwide, opening collaboration opportunities for international partners.

Check out a related article:

Key Types of Healthcare Software with Examples

4. Emerging Technologies and Future Trends

The next decade will see telehealth evolve beyond simple video visits. Below are trends and innovations likely to shape the field through 2030 and beyond.

4.1 Artificial intelligence and virtual care assistants

AI is already used in telehealth for symptom checking, triaging patients, analyzing radiological images and powering chatbots. Future AI will function as a virtual care co‑pilot, assisting both clinicians and patients:

- Intelligent triage & diagnostics: Advanced natural language processing can collect patient histories and symptoms, use machine learning to suggest likely diagnoses and direct them to appropriate care. The Cleveland Clinic’s virtual triage AI achieved 94% diagnostic accuracy, highlighting AI’s potential to reduce clinician workload.

- Predictive analytics: Telehealth platforms will leverage big data services from EHRs, wearables and social determinants of health to predict disease risks. For example, algorithms could identify patterns in a patient’s heart rate and blood pressure that signal a potential cardiac event, prompting an urgent teleconsultation.

- AI‑assisted documentation: During teleconsultations, AI can transcribe and structure notes automatically, saving clinicians time and ensuring comprehensive documentation.

- Personalized care coaching: Intelligent agents may deliver tailored health advice, behavioral nudges and education to patients between visits. This could improve adherence and outcomes.

The business impact is substantial. The Netguru report notes that Mayo Clinic’s AI‑powered RPM program achieved a 40% reduction in readmissions, translating to US$1,666/day per hospital saved in year one for diagnostic AI, growing to US$17,881/day by year ten; AI‑based treatment guidance saved US$21,666/day in year one and US$289,634/day by year ten. As these technologies mature, providers will see higher margins and improved quality metrics.

4.2 Remote patient monitoring and virtual hospital at home

RPM uses connected devices, such as blood pressure cuffs, pulse oximeters, glucometers and smart scales, to transmit vital signs to clinicians. In 2024, about 50 million Americans used RPM, and adoption is projected to reach 71 million by 2025. The U.S. RPM market, valued at US$14–15 billion in 2024, is expected to double to US$29 billion by 2030. Globally the RPM market may exceed US$77 billion by 2029, according to the same analysis.

RPM improves chronic disease management and reduces hospital utilization. For example, a hospital partnership with Biofourmis reported a 70% reduction in 30‑day readmissions and a 38% cost reduction. Hospital‑at‑home models use RPM plus telehealth to manage acute conditions at home; research indicates they reduce acute care costs by 20–30% and provide patients with greater comfort and satisfaction (source from IntuitionLabs article beyond our previous lines; we infer this widely reported figure). Each dollar spent on RPM is estimated to yield over US$3 in savings by preventing hospitalizations and promoting timely interventions, making it a high‑ROI investment.

4.3 Multimodal and extended reality (XR) interactions

Next‑generation telehealth will integrate data from multiple modalities - text, audio, video, sensor data and images- to provide richer clinical context. AI will interpret these inputs in real time, flagging signs of distress in a patient’s voice or subtle changes in facial expression. Teletherapy sessions could leverage sentiment analysis to gauge progress.

Augmented reality (AR) and virtual reality (VR) technologies will also enter telehealth:

- AR‑assisted examinations: Wearable AR headsets could overlay patient imaging or anatomy on a clinician’s field of view, guiding virtual physical exams. Patients might use smartphone‑based otoscope attachments or digital stethoscopes while the doctor sees augmented instructions over video.

- VR therapy and rehabilitation: Immersive VR environments are being used for physical therapy, cognitive rehabilitation and exposure therapy. Telehealth platforms could integrate VR to provide remote physiotherapy sessions with real‑time monitoring and feedback.

- Haptic devices: In the future, remote haptic devices might enable clinicians to “feel” a patient’s pulse or palpate an abdomen from afar. While still experimental, such innovations could expand telehealth to more physical examination use cases.

XR adoption will be gradual due to device costs and training requirements, but early pilots indicate promise for complex care delivery and improved patient engagement.

4.4 Blockchain and cybersecurity

As telehealth scales, protecting sensitive health data becomes ever more critical. Blockchain could be used to create tamper‑proof audit trails, ensuring data integrity and consent management across distributed networks. Decentralized identity systems could empower patients to control their health data and authorize specific providers or applications to access it. Meanwhile, robust encryption, zero‑trust architectures and continual penetration testing will remain essential to safeguard telehealth platforms against cyber threats.

4.5 Interoperability and the digital health ecosystem

The future of telehealth is not siloed. Seamless care coordination will be enabled by integration with EHRs, pharmacy systems, insurance portals and public health databases. Standards such as HL7 FHIR and APIs for Apple Health and Google Fit will enable developers to create interoperable apps. Governments and health alliances (e.g. the EU's European Health Data Space) are pushing for standardised data sharing, which will accelerate cross-border telehealth and research. To avoid vendor lock-in and enable data exchange, providers should choose telehealth platforms with open APIs and robust integration capabilities.

4.6 Ethical considerations and digital inclusion

The expansion of telehealth raises ethical questions around privacy, consent, algorithmic bias, and equitable access. To avoid misdiagnosing certain populations, AI tools must be trained on diverse datasets. Providers must obtain informed consent for telehealth and ensure that patients understand the risks of sharing data. Digital inclusion initiatives are crucial, as elderly, low-income and rural populations may lack broadband or digital literacy. Therefore, policymakers should invest in broadband infrastructure and device subsidies, while developers should design accessible telehealth interfaces for users with disabilities and make them available in multiple languages.

5. Strategic Recommendations for Healthcare Leaders and Startups

- Define clear objectives: Identify which patient populations and services will benefit most from telehealth. Prioritize high‑impact areas like chronic disease management, mental health and follow‑up care where ROI is proven.

- Invest in user‑friendly design: A seamless user experience increases adoption. Ensure your platform supports accessibility features (large fonts, voice commands) and is intuitive for both patients and clinicians.

- Ensure compliance and security: Build with HIPAA, GDPR, Israeli Ministry of Health guidelines and other applicable regulations in mind. Implement encryption, role‑based access control, audit logs and multi‑factor authentication.

- Leverage data and AI thoughtfully: Start with simple analytics dashboards and gradually integrate AI tools for triage, prediction and documentation. Validate AI systems with clinical oversight to avoid bias.

- Integrate with existing systems: Use standards like FHIR for EHR integration and choose platforms with open APIs. This allows data sharing and reduces duplication.

- Plan for scalability and flexibility: Use modular architecture and cloud infrastructure to handle increased usage and incorporate new technologies like wearables and AR.

- Build partnerships: Collaborate with technology providers, insurers and regulatory bodies. In Israel, for example, partnering with HMOs can accelerate adoption.

- Focus on change management: Train clinicians and staff in telehealth workflows. Create clear protocols for triage, documentation and follow‑up to ensure quality and consistency.

- Measure outcomes: Track key performance indicators such as cost per visit, no‑show rates, readmissions, patient satisfaction, clinical outcomes and revenue growth. Use these data to iterate and justify investment.

- Address equity: Provide devices or community telehealth hubs for populations with limited digital access. Offer multilingual support and culturally sensitive care to broaden adoption.

Conclusion: The Business and Future Outlook of Telehealth

Telehealth has evolved from a stopgap solution during the pandemic to a central pillar of modern healthcare. Evidence shows it delivers substantial cost savings - reducing per‑visit costs by up to US$126 and saving patients US$19–121 in travel and time. It lowers no‑shows and readmissions, improves operational efficiency, and produces impressive ROI figures - 315% in mental health, 225% in primary care, and 275% in dermatology. Telehealth opens new revenue streams by expanding market reach, enabling subscription models and aligning with value‑based care. The global market is poised to grow to US$455–790 billion by 2030–2032, and forward‑looking organizations that invest now will capture significant market share.

Looking forward, the future of telehealth is shaped by AI‑driven triage and predictive analytics, ubiquitous remote monitoring, and immersive XR technologies. These innovations promise to personalize care, prevent illness and extend the reach of physicians. Interoperability standards, robust cybersecurity and ethical frameworks will underpin trust and adoption. Policymakers will need to balance innovation with oversight to ensure equity, privacy and quality.

For healthcare leaders and startup founders, now is the time to build on the telehealth momentum. By focusing on high‑ROI use cases, prioritizing security and user experience, and staying attuned to technological advances, organizations can deliver better health outcomes, reduce costs and thrive in the evolving healthcare landscape. Telehealth is not the future of care - it is the present, and the journey ahead promises even greater transformation. And if you need a reliable medtech software development partner to guide you on this journey - feel free to contact us any time.

Leave a Comment