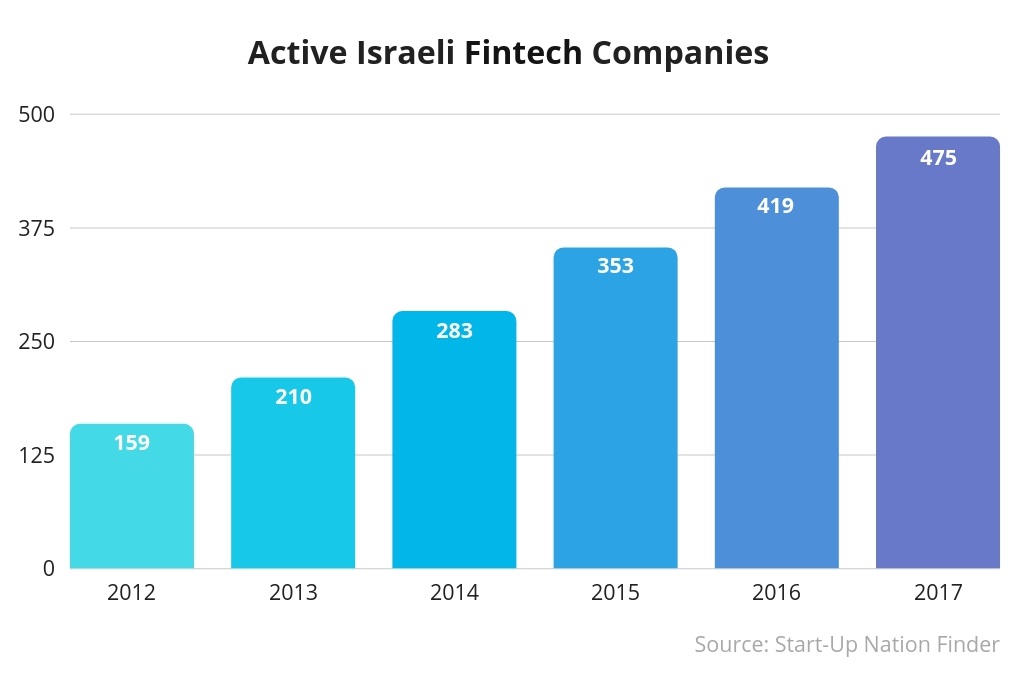

Over the last few years, we’ve witnessed a huge disruption of Israel’s FinTech landscape. Global financial giants are increasing their findings to local enterprises, world-leading companies open new Israeli offices, and the number of startups has tripled as compared to 2012.

Here are only a few numbers provided by the most recent Startup Nation Central report:

- In H1 2018 the number of investment deals has gone through the roof: more than $400 million was raised in 45 deals (+33% and +45% to the previous half-year numbers, respectively);

- The median deal size has a reached the all-time maximum of $30 million, which is almost 3 times higher than in the previous period;

- This year, foreign investors participated in 60% of Israeli FinTech deals and multinational corporations were involved in 38% of investment deals;

- Around 16 global financial powerhouses, including AXA insurance, Visa, Mastercard, and BNP Paribas, have either opened new offices in Israel or diversified their activities to include the local FinTech sector.

According to Deloitte’s Israel Fintech Landscape Report, the number of Israeli financial startups has already surpassed the mark of 500. While in 2012 there were only 159.

What makes Israel a kindly soil for Fintech development?

First of all, it’s a small size, which makes it a perfect test ground for new technologies and, at the same time, encourages founders to focus on growing global. The second is deep technological knowledge and high level of mobile adoption among the local population.

For many, the secret weapon of Israeli innovation is elite army intelligence units like 8200, which have risen dozens of FinTech companies’ founders (e.g. BillGuard, ThetaRay, Trusteer).

Another growth driver is how the government and startuppers themselves deal with business issues. In Israel, it's in the nature of things if a local entrepreneur experiences failure and moves on, while in most foreign countries failure is unacceptable.

Fintech outsourcing on the rise

Another trend fostered by such an explosive growth of the sector is that more and more companies tend to partner with software development outsourcing companies. The rapid growth has resulted in a talent gap when the demand for experienced engineers has significantly overcome the supply. So, the owners do their best to fill the gap with high-quality talents from less dense markets.

Ukraine is the main destination for such companies and the governments of both countries only nurture this cooperation. As of today, 15,000 Ukrainians are working for Israeli high-tech companies, and dozens of Ukrainian outsourcing companies operate on Israeli territory.

Ukraine is the main destination for such companies and the governments of both countries only nurture this cooperation. As of today, 15,000 Ukrainians are working for Israeli high-tech companies, and dozens of Ukrainian outsourcing companies operate on Israeli territory.

“In my opinion, the cost is not the major benefit of outsourcing development. To stay competitive outsourcing companies need to keep up with all trending technologies, not only FinTech-related. So, when cooperating with such firms, startups get a chance to upgrade their projects with features from areas they haven't even taken into an account.”

Kate Goldberg, the COO of Intersog

Conquering new areas

The rapid growth of the industry and the introduction of disruptive companies has resulted in the emergence of new Fintech subcategories:

WealthTech

A rising global trend that focuses on enhancing wealth management and the retail investment process. Over the last quarter, the investment in the area has grown 6-fold.

RegTech

RegTech companies help businesses comply with rules and regulations by using new technologies such as cloud computing and big data for the sharing of information.

InsurTech

InsurTech companies develop insurance-related products and services with a special focus on areas avoided by large firms such as ultra-customized policies, social insurance, and using internet-enabled devices to dynamically calculate rates based on behavior.

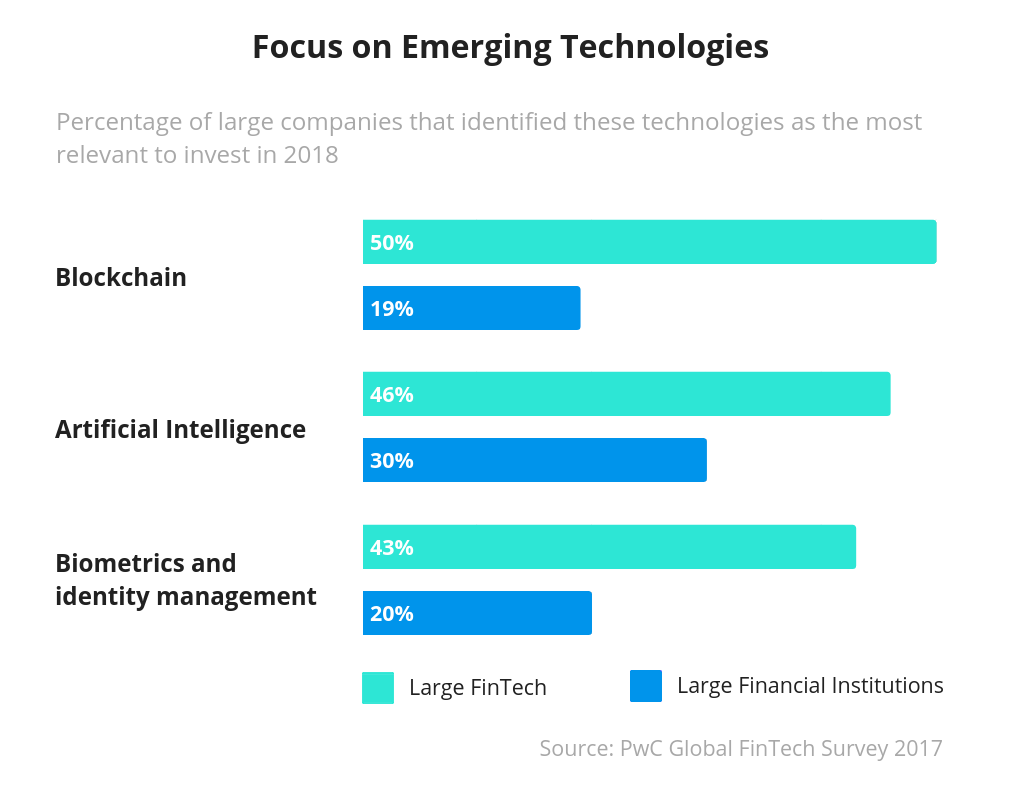

Adoption of new technologies

FinTech has transformed the way people deal with payments. As a result, startups and traditional financial institutions such as banks are now balancing their efforts between delivering seamless user experience and gaining more revenue along with minimizing operating costs. In such circumstances, using hi-end technologies will become extremely popular.

Blockchain

Due to a secure and transparent way of sending digital assets omitting third parties blockchain development is essential for organizing P2P, B2B cross-border and immediate financial transactions. According to PwC, 4 77% of financial institutions are planning to adopt blockchain by 2020, and most of them are already working on at least one blockchain project.

Big data & Machine Learning

Being an extremely data-dependent area, Fintech leverages these technologies to evaluate and predict user behavior in order to make more informed decisions about borrowers.

Cognitive Data Analytics and AI

These allow risk assessment, fraud prevention, and credit scoring to be processed effectively and to prevent issues related to the human factor. It also helps to offer more targeted solutions, better customer service, and personal asset management recommendations.

Biometrics

Companies use it to enhance the security of operation by utilizing specific personal metrics, such as fingerprint or facial recognition.

With all these new technologies and high levels of competition, the future FinTech services will evolve even more customer-centric. The digitalization of financial transaction meets the users’ demand as they no longer want to use outdated banking solutions. In the closest future, we’ll see the financial industry being totally reshaped. And Israel is going to become one of the leaders of the FinTech revolution.

Leave a Comment